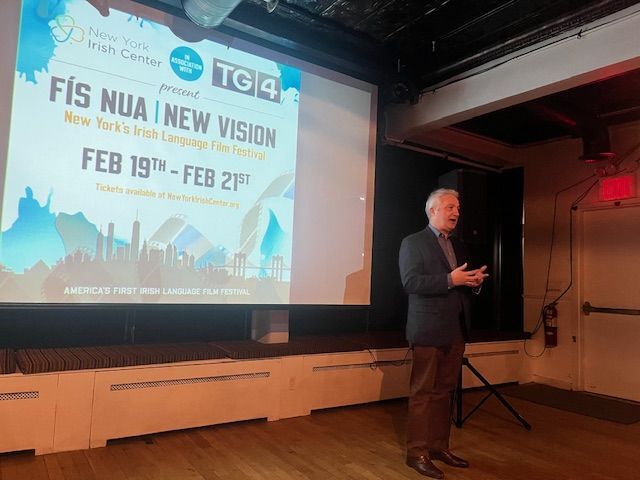

Michael George will be honored on Friday at the New York-New Belfast conference. PHOTO BY NORA SCALLY

By Peter McDermott

“I finance nice buildings.”

That’s how Michael George describes his work.

His official job title is Head of Business Development and Investor Relations of Versant Investment Management LLC.

“We sold an apartment to the richest man in New Zealand this week for $34 million,” the Northern Ireland native said in an interview last Friday afternoon.

It wasn’t the biggest price tag of the week in New York’s high-end real estate sector. Jeff Bezos bought an apartment for $80 million.

Seated in the balcony area of his company’s 15th-floor office complex on Madison Avenue, George was well-placed to talk about the sector. He pointed to a nearby Robert Stern-designed building. “He probably gets the highest prices of any architect in the city. He appeals to a very specific sort of buyer,” he said. “He’s a brand. People love his buildings. That one is full of billionaires.”

George, who is being honored this week at the New York-New Belfast conference, discussed also the exceptionally slender and tall building a block south and east. “That’s very high end,” he said. Four years after completion, 432 Park Avenue, between 56th and 57th Streets, has already established itself, he added, as “one of the iconic buildings of Manhattan, if not the world.” This is in part because it is the second tallest in New York after One World Trade Center and it has the highest rooftop in the city. It’s ranked third in the U.S. in terms of height and is also the tallest residential building on the planet.

An engineer by training, George can appreciate and admire the conceptual thinking that went into 432 Park Avenue, especially the part of that that prevents it from swaying. But the Downtown Manhattan resident was likely speaking for many when he said that he wouldn’t live in it himself.

The Empire State Building, still New York’s most iconic structure, “was built to boost demand and to give a bunch of people jobs” nine decades ago.

“We build to try to make money,” George said. “On our side of the business, we lend to the developers at a lower-cost basis, so that they can actually get their buildings built.”

Versant’s partner HFZ is a developer and puts equity into the building itself.

Paying top dollar

“The skillset you need is to identify the area, the trend, the price point, what people are going to buy, where they’re to buy, the size of the apartments. You can’t just throw up something in some area and hope.”

It’s more of an art, George suggested, as with an architect.

“You’re going to have to build an iconic building if you’re going to have someone who’s going to pay top dollar for it. It’s very competitive. You’re competing against people who see the best product in the world,” he said.

George means people like Jeff Bezos and the New Zealand client.

“These people are the richest people in the world; and they see the best product in the world. So you have to put out the best product.”

Money came into the U.S. in 2014-15 when conditions were better. “Not just New York. London, San Francisco, Los Angeles etc. All the gateway cities,” he said. “That’s why you see a lot of cranes.”

But prices have had to come down to attract new buyers. The real problem, these days, is selling apartments in the middle of buildings. What developers could once sell for $3,500 per square foot might now be priced at $2,500.

“What’s happening at the moment is the Chinese aren’t coming into the market anymore

They had a very few people at the top of the economy who were getting very, very wealthy and they were getting the hell of China, and the Chinese government said, ‘No more. Let’s try to rebalance the economy.’”

“In many ways, I think that’s good,” he said.

Long Island City over the East River in Queens is “very interesting area where real workers live,” George continued. “Even though Amazon aren’t going there. it’s probably going to continue to develop. The land is very cheap. The rentals work over there. In Manhattan the rentals don’t really work. You’ve got to sell condos.”

Short-term pain

George was educated at the Royal Academy Belfast before going on to study engineering sciences at St. Catharine’s College, Cambridge, where he continued with postgraduate studies in computer science. While at Cambridge, too, he played rugby for the university’s first XV. He joined Lehman Brothers upon graduation in 1986. He was sent for an early stint in New York in the late 1980s and has been in the city full-time since 1992.

In 1999, George joined Deutsche Bank. “I like to tell everybody that when I left Lehman Brothers, everything was fine,” he said of a company that filed for bankruptcy in 2008.

His last position in his 10 years at Deutsche Bank was as managing director in the Institutional Client Group with responsibility for its largest North American clients. He was appointed managing director of Fortress Investment Group LLC in 2009 and joined Versant in 2017.

George said he only has occasional regrets about leaving London. “It wasn’t the city it is today. In the 1990s, the infrastructure was very bad,” he recalled. “Everything shut at 5 o’clock at night. Getting to the airport was a disaster. But today London has caught up in terms of amenities.”

He retains strong ties to Europe. His mother and brother are in Northern Ireland, while his sister lives in England. He has a place in Paris and stays there frequently. On the issue of Brexit, he said: “There will be short-term pain; I’m not convinced there’ll be long-term gain quite frankly, but if it’s what people want, democracy has to be respected.

“There’s no will on either side to put up a hard border,” George said in relation to the island of Ireland. “There’ll be a little bit of noise about the regulatory stuff, which will all get sorted out. And the British have offered full monetary compensation for any sort of digital technology that would be needed.

“I think there could be pretty significant disruption [because of Brexit]. I don’t think people realize what sorts of disruptions there will be.”

Yet he does not believe the direst predictions that have been made. “It will be like ‘Oh, we hadn’t thought of that. We’ll have to sort that out,’” he said. “These are just the practicalities we’ll have to deal with.”

The one possible advantage coming out of Brexit could be an American bilateral trade deal with the UK — if it’s not a disadvantageous one forced on the latter due to its weakness.

“The one EU country that could benefit ironically is the South of Ireland, being next to the North,” he said.

George was critical of Taoiseach Leo Varadkar. “I think he should have been more accommodating to the British,” he said. “He’s definitely dug his heels in. At the end of the day the British are closer to the Irish than the French or the Germans. Leo doesn’t realize that. The Germans and the French, if they don’t need him they’ll toss him aside.”

More broadly, he’s not keen on making predictions, especially about what might be next big thing.

“In my era we were engineers. We went into financial engineering and we kind of destroyed the world,” George remembered. “I never did any of it, by the way, but a lot of people did these fancy financial products when we would have been better off putting that intellectual capital into something much more productive. We trained all these engineers and rather than building high-speed railway engines they built CDOs [collateralized debt obligation], what Warren Buffet called ‘weapons of mass destruction.”

The move to cities

“If you were a young person, what would the next thing go into to make a good living for yourself over and above the average? I wouldn’t send anybody towards financial engineering. I think that’s the last 25 years.”

“Renewables and solar. That may have some legs to it.”

“I’ve two 24-year-old daughters, I’ve directed them into the real estate business, because we’ve got such terrible infrastructure in New York and buildings always have to be replaced and changed.

“The U.S. has trillions of dollars of infrastructure spending to be done,” George said. “So that’s an area that could be looked at.”

As for life advice for someone intent on going into business, he said, “Get a good broad general education. That’s the first thing. Education is something that nobody can take away from you. Secondly, don’t specialize too early.

“Learn how to problem solve and think,” he said, adding that his engineering science degree thought him how to solve problems.

“Then continue to learn and innovate. Try to stay current. You don’t have to jump in and get in every trend. But know what the young people are doing. Understand what they’re doing,” George said. “Even from my business, I need to understand why the young people today want to live in cities. They don’t want to live in the suburbs.”

Forty years ago, Ivy Leaguers went back to where they came from. Now the graduates of the top 20 colleges are flocking to America’s seven or so most important cities.

“That affects my investing style. That affects where we put our money; affects the cities that we invest in. We have to understand young people. The jobs they want to do. it doesn’t mean we have to live like them. But it means we have to understand them.”

Twenty years ago the gurus said we’d all be living in farmhouses talking to each other over the internet. “And the reality is just the opposite happened,” George said.